He had numerous other positions in industry bodies. Madoff was active in the National Association of Securities Dealers (NASD), a self-regulatory securities industry organization, serving as the Chairman of the Board of Directors and on the Board of Governors.

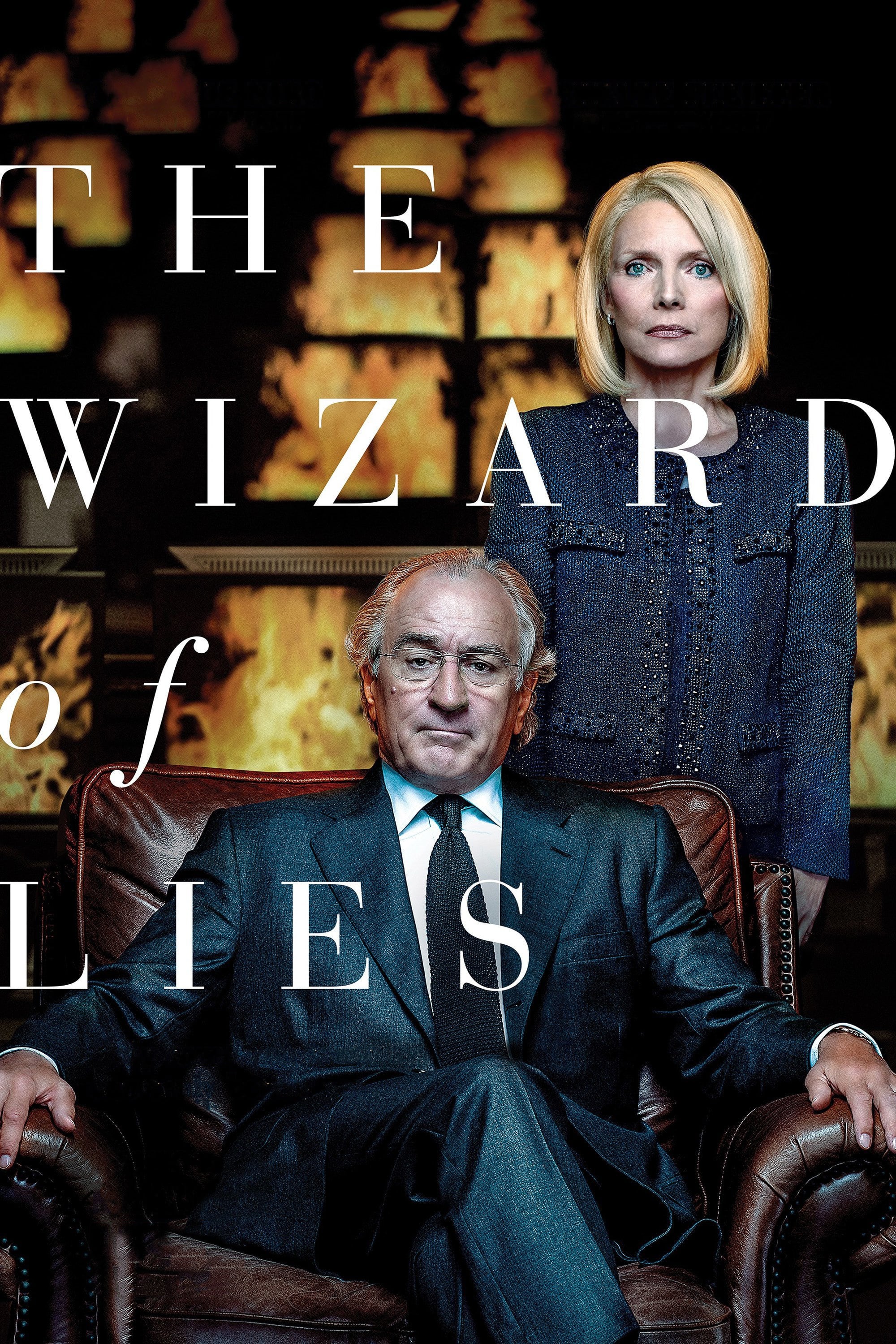

He later served as NASDAQ chairman for three one-year terms. His firm developed the technology that helped bring NASDAQ into being. Indeed, Madoff had a distinguished career on Wall Street. Everyone agrees that Madoff was considered a “brilliant” financial figure, “a true pioneer,” one of “the most honorable traders of our time.” Madoff is taken into custody, his business operations are seized, the story makes headlines all over the world. When FBI agents show up at his door, desiring to know if there is an “innocent explanation” for the apparent malfeasance, Madoff glumly says, “There is no innocent explanation.”Įvents proceed from there. Mark and Andrew, to prevent themselves from being prosecuted as accomplices, essentially turn their father in to the authorities. There’s nothing left.” He terms it “a big Ponzi scheme.” The sons respond with understandable outrage: “How could you do this?” His only explanation is that he “couldn’t admit failure.” I took some money from some people and gave it other people. This arouses the sons’ suspicions and they demand an explanation.īack at his penthouse apartment, Madoff bluntly tells Mark and Andrew, as well as his wife, Ruth (Michelle Pfeiffer)-all of whom are assumed by the filmmakers to have known nothing about his criminal enterprise-that “There are no investments. Out of the blue, Madoff (Robert De Niro) informs his sons, Mark (Alessandro Nivola) and Andrew (Nathan Darrow), and associates that he has decided to hand out $175 million in bonuses, months ahead of schedule and in the middle of the crash. This no doubt helps account for its narrow, sanitized quality.Īfter a prologue set in a North Carolina federal prison, Levinson’s film turns to the dramatic events of December 2008. Henriques was the first journalist to whom Madoff spoke in prison and her nonfiction work is the basis for the HBO film of the same title. Interviews conducted by New York Times reporter Diane Henriques (who plays herself) with Madoff in prison in 2010 form the scaffolding for The Wizard of Lies. In any event, the largest financial fraud in history, as the WSWS noted in December 2008, was nothing less than “the convulsive outcome of decades in which a vast accumulation of personal wealth at the top has been achieved on the basis of semi-criminal forms of financial manipulation.” Moreover, we noted, the Madoff investment scandal underscored the fact that, for all intents and purposes, “the entire economy has been transformed into a giant Ponzi scheme.” His claim that he acted virtually alone in perpetrating a $65-billion dollar con did not have the slightest credibility. Madoff’s decades-long operations implicated some of the biggest financial institutions in the world, who at the very least made billions in fees from his transactions. Michelle Pfeiffer and Robert De Niro in The Wizard of Lies

0 kommentar(er)

0 kommentar(er)